The platform will help investors find information about Ukrainian startups more easily.

ICU VENTURES BECAME THE MAIN PARTNER OF THE LARGEST UKRAINIAN STARTUP DATABASE

Dealroom.co, Europe’s most comprehensive technology industry data and intelligence platform, in partnership with consortium of Ukraine’s leading ecosystem players has launched the most extensive startup and venture capital ecosystem platform dedicated to the Ukrainian tech scene to date.

The consortium is led by ICU Ventures, Kyiv-based venture capital fund that invests in technology companies with strong ties to Ukraine and Eastern Europe, part of ICU group.

Other partners are the Ukrainian Venture Capital and Private Equity Association (UVCA, unites 50+ investment funds from Ukraine and globally), Western NIS Enterprise Fund (a $150 million regional fund), Horizon Capital ($850 million assets under management), TechUkraine (a nation-wide platform, uniting key Tech players to develop the ecosystem) and AVentures Capital (seed stage investor). We’ve also partnered with AIN.ua, Ukraine’s leading tech publication with over 1 million monthly visitors.

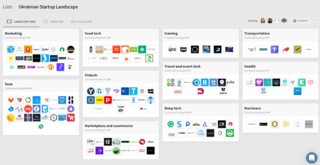

The ecosystem platform provides insights about Ukrainian startups, scaleups, corporates, investment by industry and much more.

“Ukraine is rich with talented IT-entrepreneurs and developers. What we lack is the ecosystem where this talent can bloom and grow big. As one of the leaders of the Ukrainian financial sector, ICU aims at helping Ukrainian startups become successful and gain international exposure. That is why ICU Ventures not only invests in startups but supports projects like creating a Ukrainian Dealroom database. It will be a one-stop for venture investors looking for information about Ukrainian companies. More visibility will bring more investment, which is crucial for aspiring startups.” - emphasized Roman Nikitov, Co-Head of ICU Ventures

Anyone can contribute to the development of the online platform by entering or updating data on startups and technology companies. Together, we will be able to build a holistic picture of the Ukrainian ecosystem to serve and inform all local and international players.

“Dealroom.co is excited to partner with the Consortium of Ukraine’s leading ecosystem players as we collectively understand the importance of data on the ecosystem in Ukraine. By being able to provide an extensive tool that is accessible for anyone in the world and to showcase what is happening in Ukraine's tech scene, especially startups and venture, we hope to bring more global attention to one of the fastest-growing hubs in Europe” – said Yoram Wijngaarde, CEO & Founder Dealroom.co.

---

ICU Ventures is a Kyiv-based venture capital fund that invests in technology companies with strong ties to Ukraine and Eastern Europe. Focused on helping ambitious founders build global businesses, ICU Ventures makes late seed and series A investments across the tech spectrum.

ICU Ventures is part of the ICU Group, an independent asset management firm founded in 2006 by senior investment professionals from ING. With significant allocations to venture capital, private equity, infrastructure & distressed debt, ICU is one of the largest and most diversified asset managers in the CEE region.